A man browsing the channel selections on TV at his home in Las Vegas.

Getty Images

In 1996, Bill Gates said "content is king," and his words became a truism in the media and telecommunications industry.

But over the last 10 years, it turned out that content distributors — AT&T, Verizon, Comcast and Netflix — were the kingmakers, spending billions on original programming and leaving smaller media companies scrambling to find their own buyers. At the same time, advertising dollars shifted dramatically from content owners to online giants who rely almost exclusively on others for their content.

A decade of shifts

A look back to 2010 reminds us that:

- Time Warner and News Corp. trailed only Disney in 2010 sales, riding growing revenue from cable networks but suffering from a weak advertising market in 2009 associated with the financial crisis.

- DirecTV was the world's largest pay-TV provider, with more than 28 million customers in North and South America by the end of 2010.

- General Electric still owned NBC Universal. It maintained total ownership until January 2011 and held on to 49% of NBCUniversal until 2013. GE's market valuation in January 2010 was $161 billion. Today it's $96 billion.

- Netflix had a market capitalization of $2.9 billion and was just beginning its shift from DVDs to streaming.

- Charter Communications was a little-known $4 billion regional cable company.

Viacom and CBS combined earlier this month, bringing together two of the largest content companies of 2010. The merger put a pin on a growing trend throughout the decade — the age of the pure content company is dying.

While Disney still exists today as a pure content company, with a market capitalization of $266 billion, the next largest ones are Discovery and ViacomCBS, each of which have market valuations below $40 billion. (Sony has an $82 billion market capitalization but entertainment is just a piece of the larger company.)

It's probable that Lionsgate, MGM and other smaller content providers will sell themselves early in the next decade to survive.

Snapchat, Facebook, Twitter, Messenger, Instagram and LinkedIn apps shown on a smartphone screen.

Chesnot | Getty Images

In the ashes of formerly dominant media and internet companies, Facebook, Twitter, Spotify, and Snap have built themselves into major modern media players. Each went public after Jan. 1, 2010, and all have market valuations of $20 billion or more.

Facebook and Google have been the most dominant forces online in the last decade, as evidenced by their market caps: Facebook's valuation today is $564 billion. Alphabet (Google's corporate name as of 2015) has a market cap of $938 billion, making it the third largest publicly traded company in the U.S., after Apple and Microsoft. Google's advertising dominance has been twofold, relying on its No. 1 search engine and the popularity of YouTube, which it acquired in 2006.

Facebook CEO Mark Zuckerberg, left, and Google CEO Larry Page

Getty Images / David Paul Morris | Bloomberg | Getty Images

Pivotal Research estimated last year that Google and Facebook accounted for 90% of digital advertising's growth. Their enormous scale and insular business models have boxed out many newer digital media companies throughout the decade. Tumblr, Buzzfeed, Zynga and other digital darlings of the early 2010s haven't been able to flourish.

Facebook's growth has also been aided by two key acquisitions — the $1 billion purchase of Instagram in 2012 and the $19 billion acquisition of WhatsApp two years later. Bloomberg last year estimated Instragram may be worth $100 billion on its own if it were a stand-alone company.

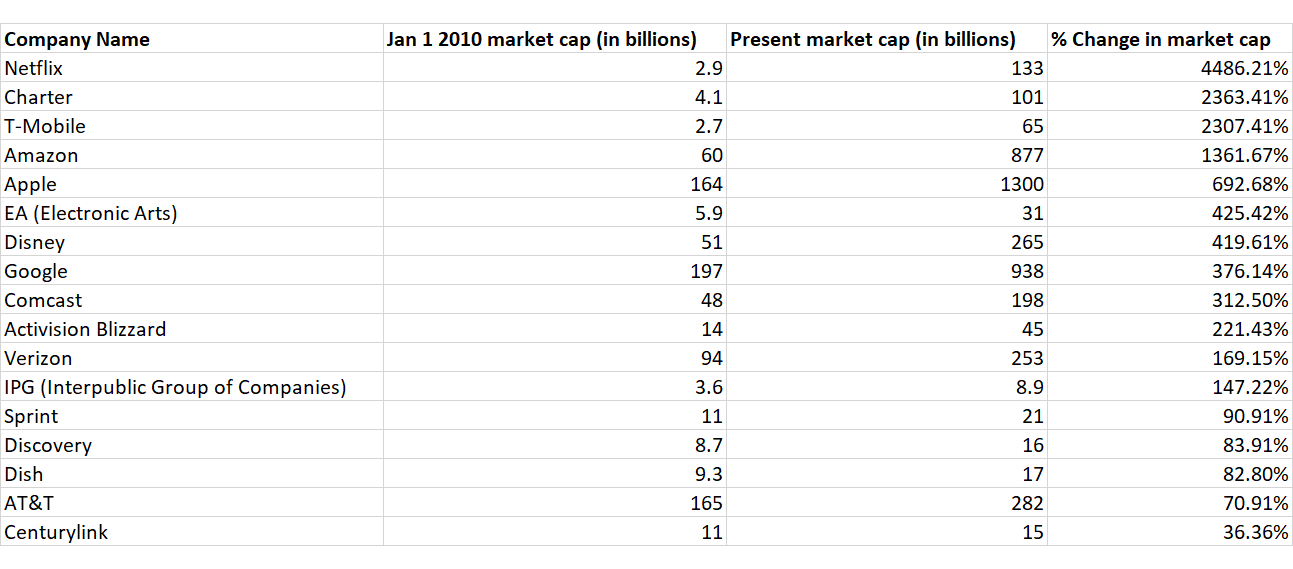

The following chart illustrates the change in market valuations among media and telecommunications companies that existed both 10 years ago and today.

Gaining dominance

Netflix had the largest gain of any of the companies in the chart during the past 10 years, rising from a $2.9 billion company in 2010 to a $132 billion behemoth at the end of 2019. While Netflix had started streaming video by 2010, it hadn't yet made its major pivot to buying original programming. That first happened in 2013 with "House of Cards," quickly followed by "Hemlock Grove" and "Orange Is the New Black," the latter continuing for seven seasons and ending just this year.

Reed Hastings, CEO, Netflix

Getty Images

Charter and T-Mobile have had nearly identical relative gains in value, though they arrived at them in different ways. Both companies have seen their market valuations rise more than 2,300%. Charter transformed from the fourth-largest U.S. cable company (behind Comcast, Time Warner Cable and Cablevision) to the second-largest cable operator, after acquiring Time Warner Cable in 2015 for $79 billion including debt.

T-Mobile used a $6 billion breakup fee from a botched 2011 acquisition by AT&T to propel itself past Sprint as the No. 3 U.S. wireless provider. T-Mobile is now attempting get even bigger: It's trying to persuade a federal judge to approve a merger with Sprint.

The other company on the chart to have more than a 1,000% increase is Amazon, which has used its dominance in retail to move into the media world with Amazon Prime Video, as well as many other new business areas.

Amazon CEO Jeff Bezos attends the Amazon Prime Video's Golden Globe Awards After Party in Beverly Hills, Calif., on Jan. 6, 2019.

Emma McIntyre | Getty Images

While some companies grew internally, others used mergers and acquisitions to grow.

Comcast acquired NBCUniversal (CNBC's parent company) from General Electric, plus Dreamworks Animation and Sky, transforming the cable operator to a major international content company. It's more than 300% larger than it was a decade ago.

Disney bought Marvel, Lucasfilm and the majority of 21st Century Fox's assets, building itself from an entertainment and theme park company to a media behemoth under CEO Bob Iger.

Failing to keep pace

While all the companies on the chart have grown since Jan 1. 2010, in part due to the severely depressed overall market coming off the financial crisis, Sprint, AT&T, Discovery, Centurylink and Dish have each grown less than 100% in market value.

Sprint has propped up its valuation by reaching the merger agreement with T-Mobile. The company would likely have a much lower value without the deal.

The fact that AT&T grew 71% during the decade is eye-opening, considering it spent $67 billion (with debt) on DirecTV in 2015 and $85 billion on Time Warner in 2018. Combined, that's more than $150 billion on two acquisitions — more than the $117 billion AT&T has grown in market value in the past 10 years. That helps explain why hedge fund Elliott Management took a stake in AT&T earlier this year with a list of demands to help it perform better in the next decade, including suggestions about new leadership.

Chief Executive Officer of AT&T Randall Stephenson (L) and Chairman and Chief Executive Officer of Time Warner Jeffrey Bewkes listen to testimony before the Senate Judiciary Committee Antitrust Subcommittee hearing on the proposed deal between AT&T and Time Warner in Washington, December 7, 2016.

Joshua Roberts | Reuters

Discovery's 84% jump in size includes a $14.6 billion acquisition of Scripps Networks Interactive in 2018. Discovery's market capitalization today is just $16 billion, indicating Discovery may have paid too much for Scripps, whose linear cable networks have gone increasingly out of style as consumers shift to streaming video.

Dish has tried but failed for the entire decade to transform itself in to a wireless company. Meanwhile, it has watched its satellite TV business hemorrhage customers. Dish is also waiting for U.S. Judge Victor Marrero to decide if it can acquire wireless airwaves and share a network hosting agreement with T-Mobile as a provision of Sprint's attempted merger with T-Mobile.

Centurylink's minimal gain in value comes in spite of buying Level 3 Communications for $34 billion in 2017. The telecommunications provider's business has struggled in the past 10 years as cable and wireless companies have moved in as competitive threats to connect homes and businesses with voice and broadband.

Disclosure: Comcast is the owner of NBCUniversal, parent company of CNBC and CNBC.com.

Correction: This story has been updated to reflect AT&T has grown 71% this decade.

Watch: Next five years will be 'spend spend spend' for streaming services, analyst says

Read More

0 Comments